1.0 BACKGROUND

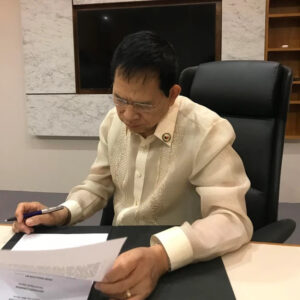

1.1 President Rodrigo Roa Duterte signed Executive Order (EO) No. 70 5. 20181, which recognizes the need to reframe and refocus the government policy for achieving inclusive and sustainable peace by recognizing that insurgencies, internal disturbance and tensions, and armed conflicts and threats are not only military and security concerns but symptomatic of broader social, economic and historical problems.

1.2 To address the root cause of insurgency and other armed conflicts, there is a need to prioritize and harmonize the delivery of basic services and social delivery packages by the government and at the same time facilitate societal inclusivity and ensure active participation of the different sector of the society in the pursuit of sustainable peace and prosperity.

1.3 One of the strategies being implemented to address development gaps is the Retooled Community Support Program (RCSP) which is a convergence mechanism for local governments, particularly at the barangay level for the identification of issues and needed government interventions. It is anchored on the empowerment framework that intends to develop people’s capability to organize themselves and implement their own programs and projects by bringing about value chain interventions to uplift their current condition.

1.4 One of the outputs of the RCSP process is the enhancement of Barangay Development Plans which identifies the priority projects/programs to address the existing issues and development gaps in the barangay level. Priority projects identified by barangay during RCSP will be funded by the Local Government Support Fund-Support to the Barangay Development Program (LGSF- SBDP) of the National Task Force to End Local Communist Armed Conflict (NTF-ELCAC).

2.0 LEGAL BASES

Under Special Provision (SP) No. 4 of the LGSF-SBDP of the NTF-ELCAC in Republic Act (RA) No. 11518 or the FY 2021 General Appropriations Act (GM), the appropriated amount of P16,440,000,000.00 shall be used for the implementation of various support programs of the eight hundred twenty two (822) cleared barangays from 2016 to 2019. Each cleared barangay shall be allocated with an amount not exceeding P20,000,000.00 to be used for the following projects:

i) Farm-to-Market Roads;

ii) School buildings;

iii) Water and sanitation system;

iv) Health stations;

v) Rural Electrification;

vi) Reconstruction, rehabilitation, repair, and other similar projects in connection with the occurrence of natural or human-induced calamities, epidemics, crises resulting from armed conflicts, insurgency, terrorism, and other catastrophes;

vii) Housing;

viii) COVID-19 vaccination, immunization and other health related projects;

ix) Agricultural, livelihood and technical vocational trainings/ projects; and,

x) Assistance to indigent individual or families in any of the following forms of assistance: (a) Medical; (b) Burial; (c) Transportation; (d) Food; (e) Cash for work; and, (f) Educational.

The President, in his Veto Message to the FY 2021 GM, placed the LGSF-SBDP under conditional implementation to subject it to the guidelines to be issued by the DBM, in coordination with the NTF-ELCAC.

3.0 PURPOSE

This Circular is being issued primarily to prescribe the general policies and procedures in the implementation of the FY 2021 LGSF-SBDP. This will likewise serve as a guide for identified local government units (LGU) in accessing the LGSF-SBDP to ensure that all abide to the policies, processes, and responsibilities in the overall implementation of the Program.

4.0 GENERAL GUIDELINES

4.1 The LGSF-SBDP shall be exclusively used for the implementation of various support programs of the 822 cleared barangays from 2016 to 2019 listed in Annex A hereof.

4.2 Pursuant to the President’s Veto Message to the FY 2021 GM, the LGSFSBDP shall be released to the Provincial Governments where the identified barangays are situated. In case when the Provincial Government is technically incapable to implement the projects identified by the cleared barangays, the project may be undertaken by an appropriate national government agency, including, but not limited to, the AFP Engineering Brigade.

4.3 The identified barangays shall submit their requests, together with the documentary requirements as prescribed in Annex B hereof, to the Regional Task Force (RTF)-ELCAC concerned, for evaluation as to the compliance with the requirements and conditions prescribed under SP No. 4 of the LGSF-SBDP under the FY 2021 GM and this Circular.

4.4 The RTF-ELCAC shall:

4.4.1 Evaluate requests submitted by the identified barangays for LGSF-SBDP and determine compliance with the documentary requirements prescribed in Annex B hereof; and

4.4.2 Endorse to the DBM Central Office (CO) eligible and compliant requests from identified barangays for immediate fund release.

4.5 The DBM CO shall process the release of funds upon receipt of endorsement from RTF-ELCAC.

4.6 Consistent with Section 28 of the General Provisions of the FY 2021 GM, the LGU5 shall ensure that the designs of all proposed projects for the construction, rehabilitation, repair, or improvement of public markets and other buildings include the installation of a Rainwater Collection System, in accordance with the prescribed design of the Department of Public Works and Highways.

4.7 Consistent with DBM-Department of Finance Joint Circular No. 2016-1 dated January 4, 2016, 3 the LGSF-SBDP shall be released directly by the Bureau of the Treasury (BTr) to the Provincial Governments where the identified barangays are located, through authorized government servicing banks, consistent with the purposes indicated in the corresponding Special Allotment Release Order and Advice of Notice of Cash Allocation Issued to be released by the DBM to the BTr.

4.8 The FY 2021 LGSF-SBDP shall be recorded as a trust fund by the Provincial Governments for the specific purpose(s) and barangays for which the funds were received and shall be made available for disbursement for the purpose specified until December 31, 2022. The Provincial Government shall maintain a separate subsidiary ledger for each project to record each transaction.

Moreover, within 30 calendar days reckoning from the date of the Notice of Authority to Debit Account Issued (NADAI), the Provincial Government through the Provincial Treasurer and Accountant, shall confirm with the DILG-RO through the DILG-PO, that the funds have been transferred from the General Account to the Trust Fund Account intended for the project.

4.9 After the end of the validity period, any unreleased appropriations shall lapse, while undisbursed funds shall revert to the National Treasury, particularly to the unappropriated surplus of the General Fund in accordance with Section 28, Chapter 4, Book VI of E.O. No. 292, s. 1987.

If at any point before December 31, 2022, the Provincial Government determines that the funds can no longer be utilized, e.g., when the program(s) and/or project(s) cannot be implemented for any reason or when the same has/have been funded from other sources, the amount received by the same LGU from the LGSF-SBDP shall be immediately reverted to the BTr.

The Provincial Government shall provide a copy of the documentation of the said transaction within 15 calendar days to DILG-RO through the DILG-PO.

4.10 Consistent with SP No. 4 of the DILG-OSEC Budget, FY 2021 GAA, the DILG shall be responsible for the monitoring and evaluation of actual project implementation. The DBM shall furnish the DILG with a list of approved projects charged against the LGSF-SBDP for monitoring and evaluation purposes.

4.0 PROHIBITIONS ON THE USE OF THE LGSF-SBDP

The LGSF-SBDP shall not be used:

4.1 For any purpose other than the program(s) and/or project(s), including the location thereof, for which the fund was released, without the prior endorsement of the RTF-ELCAC and approval of the DBM;

4.2 To fund projects already fully covered by the other sources of funds; and

4.3 For the payment of Personal Services expenditures (i.e., payment of salaries, including honoraria, allowances, bonuses, and similar forms of compensation).

5.0 PROJECT IMPLEMENTATION

5.1 Disbursement and utilization by the LGUs shall be subject to pertinent provisions of the Government Procurement Reform Act (RA No. 9184) and its 2016 Revised Implementing Rules and Regulations (IRR), and any relevant policies issued by the Government Procurement Policy Board (GPPB), as well as the applicable budgeting, accounting, and auditing rules and regulations.

5.2 The Provincial Governments may directly implement their projects by administration or by contract or they may opt to enter into a Memorandum of Agreement (MOA) with the concerned National Government Agency (NGA). The concerned NGA shall provide technical assistance and/or implement the project consistent with existing laws, rules and regulations.

5.3 Pursuant to SP No. 4 of the LGSF-SBDP, FY 2021 GM, PA No. 11518, corresponding allocation for the COVID-19 vaccination, immunization and health related projects shall be implemented in accordance with the rules and regulations issued by the Department of Health and/or the Inter-Agency Task Force for the Management of Emerging Infectious Diseases.

5.4 The Provincial Government or implementing NGA shall ensure compliance of infrastructure projects with Section 26 of the General Provisions of the FY 2021 GM.

6.0 POSTING AND REPORTING REQUIREMENTS

The Provincial Governments shall:

6.1 Comply with the posting requirements prescribed under RA No. 9184 and its 2016 Revised IRR, and all relevant policies issued by the GPPB;

6.2 Prepare quarterly reports on fund utilization and status of program/project implementation using the prescribed format (Annex C) until such time that the Unified Reporting System for LGUs has been developed and can be used by the LGUs.

6.3 Consistent with the Full Disclosure Policy of the DILG, post the same reports in at least three (3) conspicuous public places in the province and on the LGU’s website within 20 calendar days from the end of each quarter, one of which shall be in the beneficiary barangay.

6.4 Send a written notice to the Secretary of DBM, Secretary of DILG, Chairperson of the NTF-ELCAC, Speaker of the House of Representatives, President of the Senate of the Philippines, and the Chairpersons of the House Committee on Appropriations and Senate Committee on Finance upon posting of the reports on the LGU’s website. The date of notice to said agencies shall be considered the date of compliance with the requirement.

7.0 RESPONSIBILITY AND ACCOUNTABILITY

The responsibility and accountability in the implementation of programs and projects, and proper utilization and disbursement of the LGSF-SBDP shall rest upon the LCE and other local officials concerned of the recipient LGU. It is also the responsibility of said local officials to ensure that the funds released to the LGU are utilized strictly in accordance with applicable budgeting, accounting, and auditing rules and regulations, and pertinent provisions of RA No. 9184.

Moreover, the LGU shall ensure that no duplication of funding will occur. As such, the LGU, through its LCE, shall immediately inform the DBM if it has received funding from other sources for the same programs or projects.

8.0 ITEMS FOR RESOLUTION

Interpretation of the provisions of this Circular, including relevant items not covered herein, shall be referred to the DBM for resolution.

9.0 SEPARABILITY

If any provision of this Circular is declared invalid or unconstitutional, the other provisions not affected thereby shall remain valid and subsisting.

10.0 REPEAL

All provisions of existing guidelines that are not consistent with this Circular are hereby revised, modified and/or repealed accordingly.

11.0 EFFECTIVITY

This Circular shall take effect fifteen (15) calendar days after its publication.

Source: Department of Budget and Management